Managed Portfolio Service (MPS) With 150 years of Investment Management and Stockbroking expertise, Redmayne Bentley offers a seamless online investing experience through our Managed Portfolio Service. Ideal for those aiming to grow their wealth over the long term, our Managed Portfolio Service starts with a minimum investment of £20,000. As with all investing, your capital is at risk. Getting started Our Managed Portfolio Service makes investing easy. Invest for the future today.

Begin your investing journey today

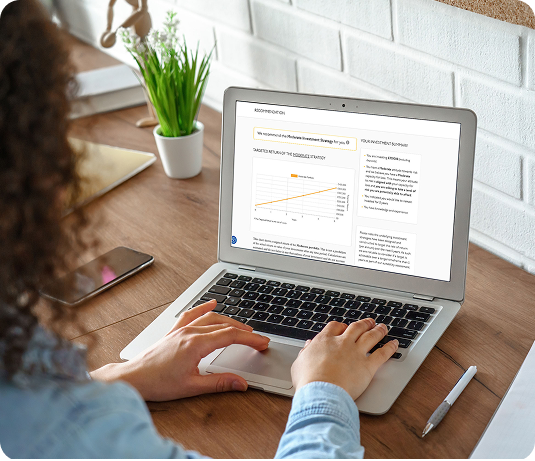

by applying online, answering questions on your investment goals and attitude to risk and receive details of your recommended investment strategy instantly.

Receive our 'Welcome Report'

when your account is up and running - summarising what we have agreed and how we will manage your investments, in line with your objectives and level of risk.

Using our expertise

we build fully diversified portfolios across a broad range of asset classes and manage these for you.

Track your portfolio

securely online with the myRB app.

Review your portfolio

with our comprehensive quarterly Investment Reports.

Invest in our Managed Portfolio Service today

Why choose our Managed Portfolio Service?

You can apply for an account today and you will receive details of your recommended strategy instantly. You will also be able to view your portfolio online 24/7 with the myRB app.

Investment Objective: You can invest for either Growth or Income

Growth Priority

Your primary focus is long-term capital growth, therefore, income requirements will not be a key consideration. This will be achieved through an approach of capital appreciation and income generation.

Income Priority

Your primary focus is on generating an income from your portfolio, with some capital appreciation to offer long-term growth potential. In an income-focused portfolio, a portion of the returns are paid out as regular payments, rather than reinvested, which naturally

results in lower capital appreciation over time. While the portfolio generates both income and growth, the regular withdrawals reduce

the amount of capital left to compound.

Our risk categories, explained...

Our Managed Portfolio Service might be for you if...

You are looking for a professionally managed investment solution with up to £100,000 to invest.

You are investing for the medium to long term e.g. 3-5 years or longer

You can afford to risk losing some or all of your money (this is possible for all investments)

If you answered yes and wish to apply, please click below

Are you looking to invest over £100,000?

We have specialist investment advisors, who can help you reach your investment goals, please click here or call 0344 259 0001.

Before applying, please read our:

More information

Guide to Investing

This guide explores the links between risk and returns and the

characteristics of asset classes we utilise in the investment

universe.

Managed Portfolio Service Brochure

This brochure outlines the features, benefits, and process of our Managed Portfolio Service, helping clients determine whether it is the right investment solution for their goals.

MPS Factsheets

An MPS factsheet provides an overview of an investment portfolio managed by a professional investment firm or wealth manager. It is designed to give investors a clear summary of the portfolio’s key details, performance, and strategy.

Don't just take our word for it...

The 2024 Investors' Chronicle Celebration of Investment Awards awarded 5 stars in the following categories:

Wealth Manager, Stockbroking, Selective ISA Provider

Investments and income arising from them can fall in value and you may get back less than you originally invested. Please note that tax treatment depends on the specific circumstances of each individual and may be subject to change in the future.